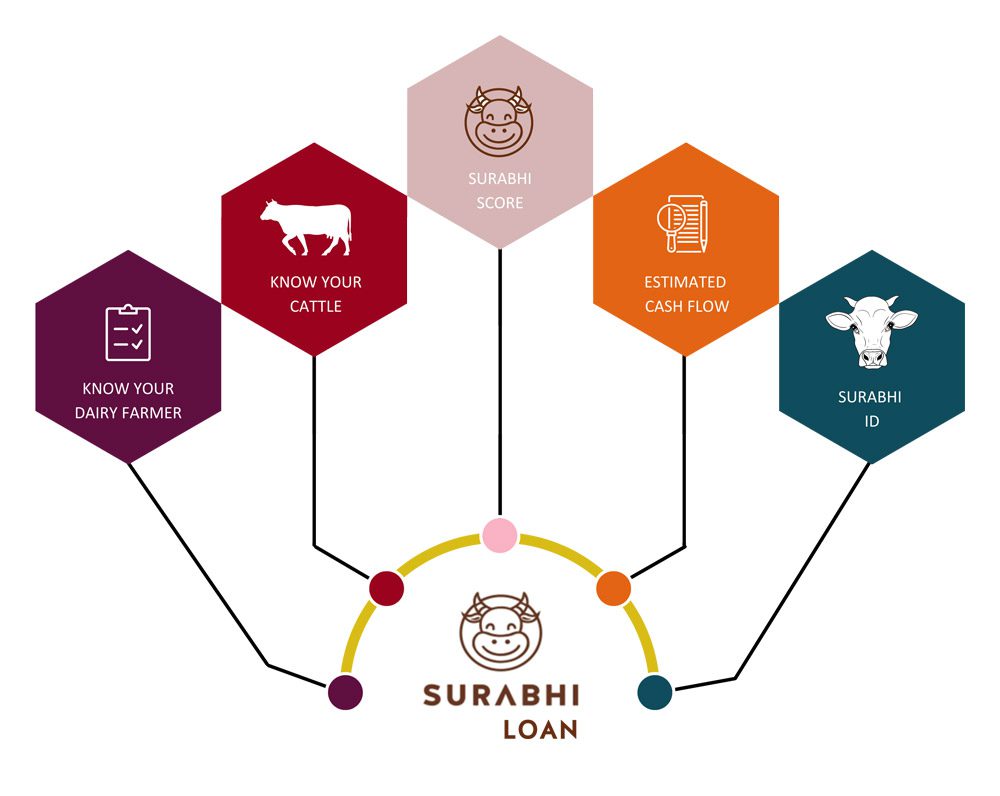

We check almost 50 plus parameters of the farmer and cattle by leveraging new age technologies.

- Know Your Customer (KYC) for Farmer

- Know Your Cattle (KYC) for cattle Digitized cattle to uniquely identity based on muzzle identity, health status, how well the farmer has been managing the cattle, estimated cash-flow by leveraging artificial intelligence.

- Surabhi Score: Comprehensive score to underwrite the cattle accurately and at scale.